Describe How You Plan to Use These Funds Sba

You need to gather paperwork not only on your personal finances but on your business history and your projections for the future. That assumes you have one thats written and well researched in the first place.

Sba Lending Tools Loan Types Incentives Seasonal Business Aid

If you are applying for an Economic Injury Disaster Loan in response to COVID-19 click here.

. We advise you to write this section last so that you can crystallize the details of your plan beforehand. The maximum loan amount for a Second-Draw PPP loan is 25 times your average monthly payroll costs in 2019 or 2020 up to 2 million. Later you can update this section when you need outside funding for business growth.

You can use your loan proceeds to pay your expensespayroll rent utilities and mortgage interest. Keeping the lights on and things running smoothly requires both time and money. Facilities Equipment and Vehicles Supplies and Advertising and Other Startup Costs.

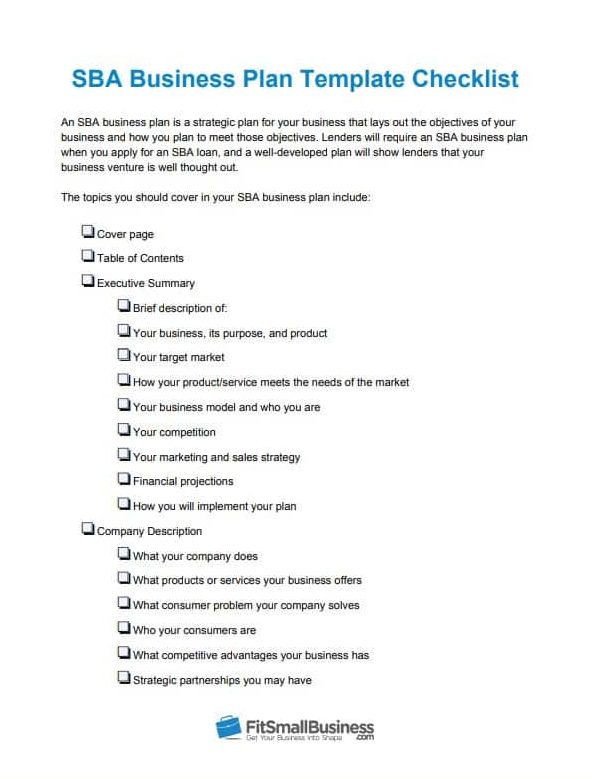

Here are 20 commonly asked business funding questions and answers to help you develop the best funding strategy for you. Make your focus and priorities clear. The cover page should contain the name of your business and your contact information.

If you are in the Accommodation and Food Services sector you. While this is not too. The executive summary should cover the essential information about your business.

Entrepreneurs seeking to finance a startup company often look to the Small Business Administration SBA for the funding they need to get their company up and running. What it does who it serves and what youre looking for from the people who read it. An example might be to provide job training and counseling that helps 40 developmentally disabled youth to develop and market their skills.

Applying for an SBA loan for your business requires preparation. Cover Page and Table of Contents. To make this easier to navigate Ive broken these questions down into six categories.

Seventeen percent of Square Loans recipients use their loan to help cover the expenses of their day-to-day operations. Clearly and briefly describe who you are your business background the nature of your business or start-up and how the loan will be used to help the company succeed. Unless there are restrictions on how you can use the small business grant money you should add your salary to the cash reserve fund as well.

Qualify for Government Contracts. Over the past year small business owners in the hair salon industry have been faced with profound challenges due to the COVID-19 pandemic. Create a Business Plan.

The startup costs are those costs required to open the business. Small Business Administration 409 3rd St SW. In addition there are other eligible uses of.

Qualified companies can use the funds to fund startup costs purchase equipment buy new land repair existing assets expand an existing business acquire a new business refinance debt purchase inventory and supplies and more. Section One is Uses of Funds The total of startup funds and working capital needs is the total Uses of Funds. I recommend that you simplify your use to no more than three items or categories with a percent.

Objectives should be tangible and should include numerical targets and other indicators of success. Lots of franchises have been adding mandatory safety steps for franchisees to put in place. How to Research and Apply for Hair Salon Financing.

You use the funding request section to provide information on your future financial plans such as when and how much funding you might need. Refinancing or paying other debts. Your business plan for a loan application is a professional document so be sure it looks professional.

Consolidating debt can be a smart way to use small business financing. Conclusion Consider a Salon Loan. One of the most beneficial ways to get the funds needed is to use a 401 k financing also called a Rollover on Business Startup ROBS in conjunction with an SBA loan.

To qualify for financing business owners need to have good credit and good business history. The executive summary will touch on the key points of your. Every business plan must contain an executive summary.

Describe the history of your business and summarize current activity and results. An Outline of The Business. Washington DC 20416.

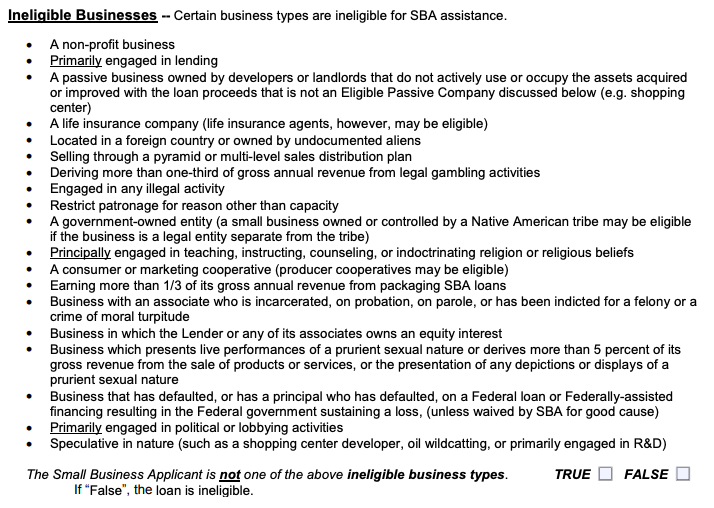

The Use of Funds section of your business plan must include all of the startup costs required as well as the working capital to sustain your business until it becomes cash-flow positive. SBAs plan for use of funds provided through public laws. You will also include the possible sources you could consider for securing your funds.

Acquire an Established Salon. Allocate six to eight percent of the small business grant money to implementing your marketing plan. These are the expenses that according to the CARES Act will be forgiven by the SBA.

For most SBA loans youll need to put together a business planone that shows how funds will be used and how the business will repay the loan over time. Describe your market your customers and your industry. In this section tell the funder what you plan to use its grant money to accomplish.

For example Small Business Administration SBA loans can be used only to operate your business. In this section use the subtotals for each section in your Startup Costs Worksheet. Here are the core components of a successful business plan for funding.

A long list of everyday expenses is not helpful here. You cant use them to pay off other debts or buy property but you can use them to purchase new equipment refinance existing debt establish a line of credit and other uses outlined by the SBA.

How An Sba 7 A Loan Works The Blueprint

Sba Business Plan Template Checklist

30 Sba Business Plan Template In 2020 Business Plan Throughout Sba Business Plan Temp Business Plan Template Pdf Business Plan Template Business Plan Outline

Comments

Post a Comment